Has The "PIGGY" Bank Gone For Good?

NEW YORK TIMES, September 24, 1950

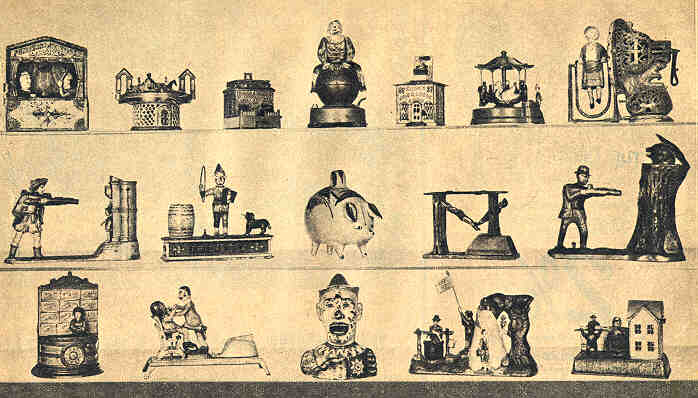

Today, you would undoubtedly consider the mechanical banks given out by the savings banks in the 1800’s as amusing and ingenious devices. And, indeed, they were. But, they represent a good deal more than that. These quaint gadgets represent the birth of the spirit of thrift — a spirit that has grown and spread through the years and contributed immeasurably to the happiness and peace of mind of the American people.

To give you an idea of just how the spirit of thrift snowballed through the years, here are some interesting facts and figures about the saving habits of the people of New York State. According to the 1950 census there are 14,700,000 people in New York State. And, out of that great number, 7,500,000 are regular depositors in one or several of the 130 savings banks in the state. Plus this, there are 2,000,000 school, Christmas and other special purpose accounts. The total amount of these savings is $11.6 billions or $1,500 per account! The people of New York City alone have saved $9.2 billions or an average of more than $1,100 for each of the city’s 8 million people. So you can see at a glance that thrift is a by-word in the Empire State.

What makes people want to save and why in a savings bank? Many "experts" believed that Social Security, unemployment benefits and organized pension plans would make people feel that saving was unnecessary because Uncle Sam would look out for them if anything happened and there was always credit buying for the "extras".

Well, the "experts" were wrong. At the end of 1941 the Savings Banks of New York State had 6 million accounts and $5.5 billions on deposit. Today, with government benefits increased and pension plans even more widespread the number of savings accounts is up 25% and the amount saved more than doubled.

WHY PEOPLE SAVE

So, what really does make people want to save as the facts prove they do? Old age, sickness or unexpected emergencies are the most often stated reasons for saving. But, actually savings are used for more interesting and attractive purposes — a new home, an automobile, a college education, starting a new business or travel — things that give enjoyment to the individual or family. These reasons give the partial answer . . . but there’s a deeper reason. Money in the savings bank gives you a freedom and feeling of independence that is priceless. Perhaps you will recall the movie "I Remember Mama" and the part her mythical savings account played in the feeling of security and happiness of her family. Jokes have been made about that "money in the bank" look. This business of saving is a fundamental element of our country . . . as American as baseball, apple pie and soda pop, the antithesis of Communism and the socialistic state. That must be why more Americans are saving more money today than ever before.

SAVINGS BANKS MOST POPULAR

Now that it’s more or less established why people save the question naturally comes up why they save in a Savings bank and not in the mattress or the much overworked tea pot. Most people answer this question quickly and positively by saying, "You can always get your money when you want it". Actually savings banks are so conveniently located that they’re almost as handy as the old-fashioned hideaway spots. Then people find savings banks such friendly places in which to do business. Everyone right up to the president is anxious to help, interested in your problems. Fact is in most communities the bank people are busy, community minded citizens, too. They feel they are servants of the community and have a very real responsibility to it not only in the bank but in the affairs of the town as well.

But, did you ever wish savings were not quite so easy to withdraw? That’s a criticism many bank people hear. You carefully map out a savings program for yourself and then demon temptation puts something in your way and out comes the money and it takes you just that much longer to reach your goal. You’d be grateful if they made it hard in that case. But supposing there was illness in the family and emergency funds were needed immediately or a business opportunity arose where you needed quick cash. It’s a grand and glorious feeling to drop around at the bank and get the money right away without red tape or penalty. This availability of your money is a fundamental and carefully cherished principle of savings banking.

But to discover the real reason savings banks enjoy the confidence and support of every person in the community today lets flip back the pages of the calendar and find out why and how savings banks were organized. The first savings bank was started in 1819 as a place where thrifty people could deposit their savings without fear of loss and where it could work for them by earning interest. At the outset it was a simple part-time operation where a small trunk was sufficient to hold cash and vital records. The founders invested these savings by financing homes and other improvements which would benefit the people of the community. But, and this is a most important "but," the money was always invested in such a way that the depositor could get it whenever he wanted. (Continued on Page 15 missing!)